In my two recent pieces I have discussed the current situation on the world market with a focus on OPEC+ actions (available here ) and a more precise the timeline of the market events will be presented (available here ). This article will be dedicated to the discussion of the strategies that in my opinion Saudi Arabia has been employing in recent years.

So why has Saudi Arabia moved in such varying fashion in the last two years? It has employed as least three distinct strategies at dealing with the other member of the oil producing cartel during this period.

The Team Player Strategy. The key concern of Saudi Arabia at the time was the recently formed OPEC+. Combining efforts with a large group of non-OPEC countries in order to better control the world oil market presented somewhat a challenge. The quota discipline shaky even inside OPEC proper, North American shale oil and gas having emerged several years ago as a very real alternative, and instability in many countries of the Middle East - all these issues alone were making the managing the situation quite problematic. And then a group of new players joining the team complicated things even further.

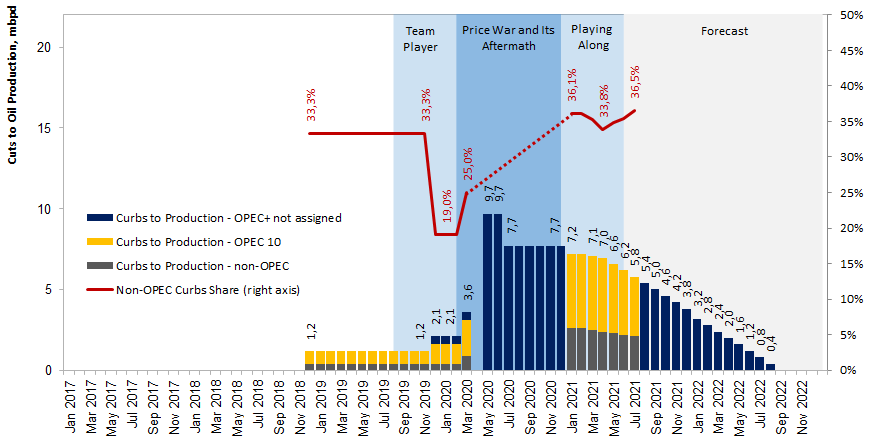

In this situation, the hard-won pre-2019 agreement saying that non-OPEC members would be responsible for a third of the cuts (see chart), was deemed reasonably fair by the market participants. When the state of affairs started to worsen, the agreement came under stress. Some of the OPEC+ producers were reluctant to embrace the new cuts proposed in late 2020. So Saudi Arabia chose to lead by example delivering the bigger part of new cuts. Several key takeaways of this action:

The Big Gun Strategy. Saudi Arabia's attitude dramatically changed in early 2020 due to a number of factors. The noble gesture of taking the hit for the others was not recognized that much. Production limit compliance levels were down. OPEC+ members refused to take part in further curbs and their part in the cuts fell from 33% to 19% (see chart). The free rider problem was exacerbating. Moreover, in March 2020 talks with Russia fell apart supposedly after the latter refused to participate substantially in the advised new cuts.

In this situation Saudi Arabia required a new strategy as soon as possible. And a new strategy was employed indeed. One can say that it was a variant of the "speak softly and carry a big stick" approach. Along the points discussed earlier it resulted in the following:

The Reasonable Leader Strategy. The radical measures taken by Saudi Arabia to fight noncompliance and instill discipline gave results fairly quickly. Talks resumed and a new agreement on cuts was reached. At the same time, the most recent argument with Kuwait shows that Saudi Arabia can be reasoned with facts (in Kuwait's case the significant investments in production facilities made prior to 2020 put the country in a position when it had a larger share of share capacity than other members). However, now Saudi Arabia is not making altruistic gestures, and concessions on its part require symmetrical actions by the other. In terms of the current strategy:

Furthermore, some new ideas were incorporated in the current OPEC+ policy approach:

Overall, after the last two years' turmoil, the current strategy looks like a return to normality. Moreover, several decisions, like better production levels transparency and laying out the plan for future actions, seem a step forward in the club's cooperation policy. We'll see if this new approach is here to stay.